Use Index Universal Life in a College Saving

For many families, college expenses can be a problem and become a financial hurdle, but fortunately, there are many tools that can help you plan and save for these expenses. A 529 plan is a tax-advantaged savings plan designed to help you save for future education costs. It offers tax-free growth and tax-free withdrawals when the funds are used for qualified educational expenses. But there is another way to save more efficiently, through IUL insurance, which offers a combination of a death benefit with a cash value component. Most importantly, IUL policies can be used to fund education but also offer you the flexibility to address other financial needs, such as retirement or estate planning.

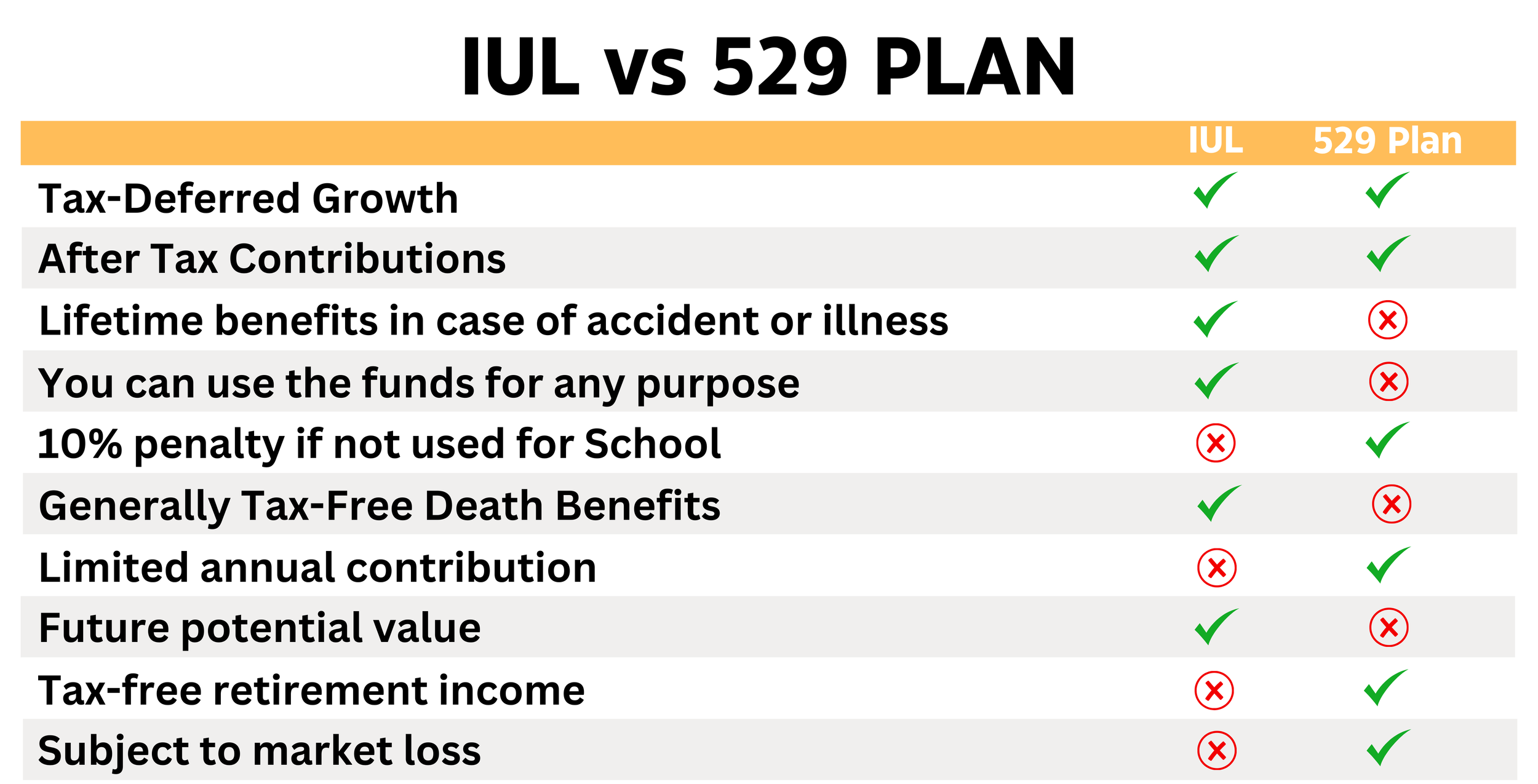

529 Plan Vs Index Universal Life (IUL)

In order to help your children avoid a mountain of student loan debt, you'll need a long-term savings plan. For many families, purchasing a tax-advantaged 529 plan is the most common option. But there are other savings methods on the market where you can maximize earnings and expand the use of your investment. Below, I'll explain more of the options for you and your family:

What is a 529 Plan?

529 plans, designed specifically for educational savings, offer tax-advantaged growth for qualified expenses. Contributions may not be tax-deductible at the federal level, but some states offer additional tax benefits. Earnings within the plan grow tax-deferred, and qualified withdrawals for educational expenses are completely tax-free at both the federal and state levels in many cases.

The primary purpose of a 529 plan is to save for qualified educational expenses, including tuition, books, room and board, and other related costs associated with higher education. Funds invested in a 529 plan can be used at eligible institutions nationwide, providing flexibility for beneficiaries who attend multiple colleges.

Contributions to a 529 plan are made with after-tax money, meaning they are not tax-deductible at the federal level. However, some states offer tax deductions or credits for contributions made to state 529 plans. One of the most significant advantages of a 529 plan is its potential for tax-free growth. Earnings within the account accumulate tax-deferred, and qualified withdrawals for educational expenses are completely tax-free at the federal level and often at the state level as well.

Advantages of 529 Plans

When it comes to saving money for education-related expenses, 529 plans have several major advantages. Here are a few:

Flexibility: Account holders can change the beneficiary to another eligible family member if the original beneficiary decides not to attend college or receives a scholarship. Additionally, the money in these accounts can be used for more than just college tuition like supplies, room and board, and the cost of trade school.

No Income Limits and Generous Contribution Limits: There are no income limits for contributors. Contribution limits are also quite high, approaching or exceeding half a million dollars in many states.

State Tax Credits and Deductions: Many states offer state tax credits or deductions for contributions to their own 529 plans.

Some things to know

529 plans charge a variety of fees. 529 plans typically include the following fees:

Enrollment fees. If you enroll in a 529 plan sold by the state in which you live, some state plans waive the enrollment fee. If you enroll in a plan in another state, you may have to pay a fee to enroll.

Annual maintenance fee. Some plans charge an annual maintenance fee, usually between $10 and $50. Many state-sponsored 529 plans reduce or eliminate this fee for state residents, for plan participants who make automatic contributions, or for those plan participants who maintain the minimum balance in their plans.

Management/administration fee. Some plans charge an annual operating fee. This fee is typically calculated as a percentage of your 529 plan balance.

Fund-level expenses. Savings plans typically allow you to choose from a number of mutual funds. Your fees may vary depending on the funds you select.

Tip: Fees vary from plan to plan. Don't assume your state's savings plan has lower fees than a national plan. Take time to thoroughly review plan documents and information and ask questions if anything is unclear. Every dollar you have to pay in fees is a dollar you may have to pay out of pocket for college.

Indexed universal life insurance is a type of permanent life insurance that combines a death benefit with a cash value component tied to a stock index.

To clarify, returns are not directly tied to stock market investments. The interest credited to the policy's cash value is determined by the performance of the chosen index, with caps and floors typically set by the insurance company.

An IUL policy offers flexible premium payments and adjustable death benefits, allowing policyholders to tailor the plan to their changing financial needs and goals. The policy's cash value component also grows tax-deferred, meaning you don't pay taxes on the earnings as long as they remain within the policy.

What Is IUL Insurance?

You can access your accumulated cash value through loans or withdrawals to fund education expenses, retirement income, your emergency fund, and more.

Advantages of IUL Insurance

IUL insurance serves a different purpose than 529 plans and offers its own unique advantages.

Versatility: IUL insurance not only offers a death benefit to beneficiaries, but also serves as a financial tool for wealth accumulation and estate planning. You can also adjust your premiums and death benefit amount to better fit your current financial situation, if needed.

High Return Potential: Policyholders can choose how their cash value is allocated among different indexed accounts, giving them control over their investment strategy. Compared to other types of insurance that grow at a fixed rate, IUL insurance offers greater growth potential. Plus, minimal fees prevent your cash value from falling when the market takes a hit.

Tax Benefits: The cash value of your IUL insurance grows tax-deferred, allowing it to accumulate more efficiently. Plus, beneficiaries don't have to pay taxes on the death benefit.

Differences between IUL and 529 plan

When planning for future financial needs, take the time to understand the key differences between 529 plans and IUL insurance. Both are valuable tools, but they serve different purposes and offer unique benefits.